Définition: Professional Indemnity Insurance

Professional indemnity insurance, often referred to as PI insurance, is a type of coverage that protects professionals against claims of negligence. Professionals can include doctors, lawyers, engineers, architects, and more. These kinds of claims maximum typically get up from the negligent overall performance of services.

- Définition: Professional Indemnity Insurance

- What is (PII) Professional Indemnity Insurance?

- Do I require insurance for professional indemnity?

- What professions need professional indemnity insurance?

- How does it work?

- How much does it cost and how do you get it?

- Personal Indemnity Insurance

- Contractor Indemnity Insurance

- Conclusion

What is (PII) Professional Indemnity Insurance?

PII is a type of insurance that protects professionals such as architects, accountants and engineers from financial liability if they are sued or held liable for damages. This type of insurance can be used to cover the cost of potential litigation and the cost of settlements. Professional indemnity insurance should not be confused with other types of insurance such as income protection or disability income, which provide a regular income for a period of time.

Purpose: Why do companies need Professional Indemnity Insurance?

Many professionals in the United States, such as attorneys and accountants, rely on PII to help protect themselves against personal liability when someone is injured or robbed due to their negligence, such as an unscrupulous client. There are various types of professional indemnity insurance that can be purchased depending on the profession and company size.

Along with these policies, it’s important for individuals to consider purchasing general liability insurance in addition to professional indemnity insurance.

Do I require insurance for professional indemnity?

Certain professions must have PIInsurance as an element of their particular regulators’ standards. Even if you’re not required to have PI insurance, if you do not have it you could be held accountable in the thousands of legal costs and compensation payments, in addition to the loss of revenue from trying to defend any claim. It is likely that you will require professional indemnity insurance in the following circumstances:

- You’d like to safeguard yourself from accusations of negligence or errors when you’ve completed work for your client You offer designs to the clients you represent (such as acting as an designer or architect)

- You provide professional advice or services to your customers (including consultancy or contractual services)

- Your industry association/regulatory body requires you to have it

- You are consultant, contractor or freelancer and your client has requested that you purchase

What professions need professional indemnity insurance?

PII to execute a contract Professional professions that may require indemnity insurance are (but aren’t restricted to):

- Engineers and technical contractors including designers for CAD project engineers, offshore engineers, and petroleum and gas engineers

- recruitment agencies as well as recruiters

- teachers or tutors including private tutors

- Business and management consultants like trainers, marketing consultants, and education consultants

- IT experts such as IT consultants, contractors, developers and programmers

- Designers like graphic designers, web designers, and interior designers

- Professionals in fitness like fitness trainers and personal trainers as well as dance instructors and yoga instructors.

You can read also:

How does it work?

PII or PI is a type of insurance that protects professionals from the financial risks they face as a result of their profession. It can also cover any legal costs incurred by the firm for which they work, as well as any fines or penalties handed out by a court as a result of an incident. In order to prevent professionals from being unfairly penalized for the mistakes made by their firms, some policies even include provisions that protect individuals from being held accountable for those errors.

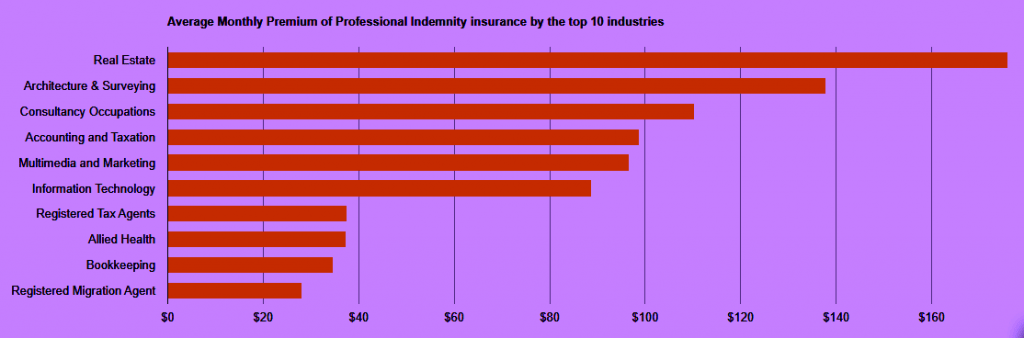

How much does it cost and how do you get it?

The cost of professional indemnity insurance is dependent on the scope of work, annual turnover, and industry. The more you are exposed to riskier activities, the more it will cost.

Professional indemnity insurance (PI INSURANCE) is vital for any business that provides professional services, such as solicitors, accountants, solicitors, or architects. It is designed to protect your business in the event of a claim against it by an individual who feels they have been harmed by your services.

Inquiring about what PII is similar to asking how long the string is because typically, the price is affected by the kind of work it covers. The more dangerous the work the more costly the coverage.

Other elements that are crucial in determining the price are:

- How much insurance coverage do you need

- The size and the amount of your business’s turnover

- Your personal claim background

- The persons being covered are competent for the work they’re performing and do they have any previous records of coverage?

In the past, professional Indemnity insurance was viewed as essential for professions like accountants, lawyers, and doctors. Nowadays, it’s a common necessity for a wide spectrum of professionals such as architects, IT contractors management consultants and real estate agents, among other health professionals. Professional photographers too should think about having Professional Indemnity insurance.

Professional Indemnity (PI) insurance is a crucial type of protection for companies that provide specialist advice or services. it provides insurance should legal action be brought against the company in the event of their client suffering losses because of the assistance or service.

You can read also:

Personal Indemnity Insurance

Is it possible for an individual to obtain an insurance policy for professional indemnity?

If you offer your expertise or expertise in the course of your work or as a self-employed person or as a representative of a business – you must consider obtaining insurance for professional indemnity.

Contractor Indemnity Insurance

Indemnity insurance is insurance that provides coverage for damages caused by the insured party. This type of protection is beneficial for contractors because they are liable for losses incurred on their property.

Types of indemnity insurance: There are two types of indemnity insurance which are business general liability and commercial property. Business general liability covers the contractor, customer, and any other third parties who may be affected by the work being performed on the property. Commercial property covers damage to the property itself due to the

Why should contractors buy PI Insurance?

PI insurance protects contractors against the financial ramifications of property damage, property loss or injury to a third party on their project site. « Without a property insurance policy, » says contractor and lawyer Barney Morrissey, « a person who has been injured on your job site may have a viable claim for personal injuries against you.

Conclusion

Indemnity insurance is an important policy that creates a means to protect the individual from any resulting losses when acting in their professional capacity.

The business owner decreases their risk of financial loss by ensuring they have this type of policy in place, which will automatically cover them for any liabilities they incur while carrying out their work.

For more articles you can visit our insurances articles from here