Introduction:

The insured lives in a state where it is necessary to purchase life insurance before the person’s eighteenth birthday. Term life insurance is a good option for a high school senior who has not yet begun working and is not yet covered. They should look into Haven Term Life Insurance reviews before their old and new policies expire and they become vulnerable.

Considering what life insurance can do for your loved ones is one of the most important decisions you will ever make. It’s also an important decision for those just starting out in life.

There are many different types of life insurance available to help protect your loved ones in the event of death. Term life insurance is one of these policies, designed to cover expenses only if the insured person dies within a specified period. The good news is there are plenty of term life insurance reviews available online to help you make an informed decision about which policy is best for you.

What is the purpose of having Haven term life insurance?

Haven Term Life Insurance is a popular option for those who don’t have life insurance in the United States.. There are many benefits to purchasing Haven Term Life Insurance, but the most notable is the price. The monthly payments are significantly lower than traditional life insurance, which is why so many people are choosing this type of coverage.

What is the difference between « term life insurance » and whole « life insurance »?

Haven term life insurance is often seen as an affordable way to hedge against the risk of death. With the high cost of living and healthcare costs, many people are finding it difficult to cover their family’s financial obligations in the event of a sudden death. Haven term life insurance is a type of coverage that provides a set amount of money in case you die during the time period that your policy is active.

Term life insurance is « pure, » but whole life insurance includes a cash value component that may be accessed at any point throughout your lifetime. The coverage provided by Haven term life insurance is a fixed sum of money in the event that you die within the time period in which your policy is in effect.

How is the policy different from other types?

Life insurance is a form of insurance that helps cover the cost of final expenses for a person or their family. The term « life insurance » doesn’t refer to a specific type of policy, but rather a broad category. There are many types of life insurance policies out there from term life insurance to permanent life insurance. Term life insurance is the most common type, where it provides coverage for a set amount of years and will expire at the end of those years.

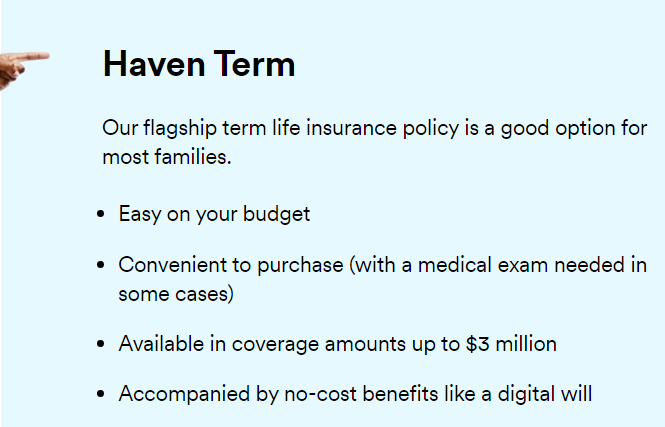

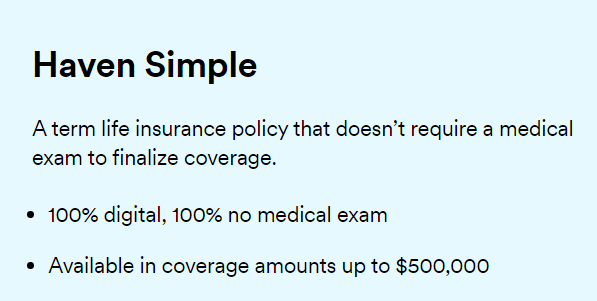

| Haven Term | Haven Simple | |

| Product type | Medically underwritten term life insurance | Simplified issue term life insurance |

| Issued By | MassMutual or C.M. Life (A MassMutual subsidiary) | C.M. Life (A MassMutual subsidiary) |

| Medical exam | Likely, but not in all cases | No |

| Availability | Nationwide | Not available to residents of CA, DE, SD, ND or NY |

| Pricing For a healthy 35-year-old man buying a 15-year, $250,000 policy | $10.68 per month | $15.75 per month |

| Coverage amounts | Up to $3 million | Up to $500,000 |

| Available terms | 10, 15, 20, 25, 30 years | 5, 10, 15, 20 years |

| Payout | Tax-free lump-sum | Tax-free lump-sum |

| Additional features | Level premiums Accelerated death benefit Paperless processing No obligation free-look period Haven Life Plus rider (living benefits) | Level premiums Accelerated death benefit Paperless processing No obligation free-look period |

Policies of Haven life insurance :

People with life insurance policies may be surprised to learn that what they thought was a standalone policy could now be tied to a different type of policy.A new kind of indemnity insurance, known as « Haven Life » plans, is now available from insurance firms. These policies cover the costs of long-term care, such as nursing homes or assisted living facilities.

The notion of life insurance is one that everyone is acquainted with. In essence, it’s a policy meant to provide protection against the risk of death. However, there are several types of life insurance policies that offer different amounts of coverage and serve particular groups of people better than others. One such type is a Haven Life Insurance policy.

Haven Life Insurance policies are geared towards those who want to provide for loved ones in the event that they pass away prematurely.

Many people are unaware that they can purchase life insurance themselves before the age of 65. Haven policies are designed for those who want to ensure their retirement, child’s future education, or other financial needs.

Life insurance is something most people don’t think about until they’re older and looking at retirement. But you can actually purchase life insurance before the age of 65! One type of life insurance is called a « Haven policy.

What are « benefits » of term life insurance?

Term life insurance is a type of life insurance that provides coverage for a limited period of time. Term life insurance has a number of advantages, including the fact that it is less expensive than whole, universal, or variable life insurance; it is also more flexible. it can be used as protection against catastrophic medical expenses; and that there are no taxes on the policy’s cash value.

How long do I need to pay a premium for term life insurance?

Haven term life insurance is an affordable way to protect your family if you should die prematurely. With premiums typically under $10 per month, it’s hard to find a better deal than this specialized type of coverage. Haven term life insurance offers a number of advantages, including limitless protection, the absence of a medical test need, and the absence of health concerns! Additionally, the policy covers the cost to set up a trust fund for your children in case you should die before they are 18 years old.

What is the difference between whole life insurance and term life insurance?

Haven Life is a term life insurance company that offers plans with rates that are based on the customer’s age and smoke status. The company does not offer any type of accidental death or dismemberment coverage, but it does provide a variety of riders for customers to choose from. The non-smoker rider, for example, includes a refund of the premium paid in the event of a heart attack before retirement age. Haven Life additionally provides low rates as well as a variety of convenient payment alternatives.

What’s the need for Haven term life insurance?

Many people mistakenly believe that they only need life insurance if they have a family or anyone to take care of them. This is not true and it can cause too much stress and worry for those who don’t purchase the necessary coverage and find themselves in this situation. When it comes to life insurance, term life insurance, also known as Haven term life insurance, is often an economical solution for individuals who don’t need long-term security but still want safety.

Haven Term Life Insurance differs from other types in that it is designed primarily to cover a single premium payment. It helps people who have

Conclusion: Why should you consider purchasing a Haven term life insurance policy?

No matter your age, term life insurance can play an important role in your financial security. Even if you’re not up for a long-term commitment, the Haven Term Life Insurance policy is one of the most affordable and worthwhile ways to protect what matters most in life: your family and loved ones. To learn more about how it provides peace of mind, click here.

Haven life quote: Easy Quotes for Term Life Insurance

for more insurance solutions click here